K-1 Frequently Asked Questions

During tax season, we understand you may have questions about your K-1s. Please see our frequently asked questions below.

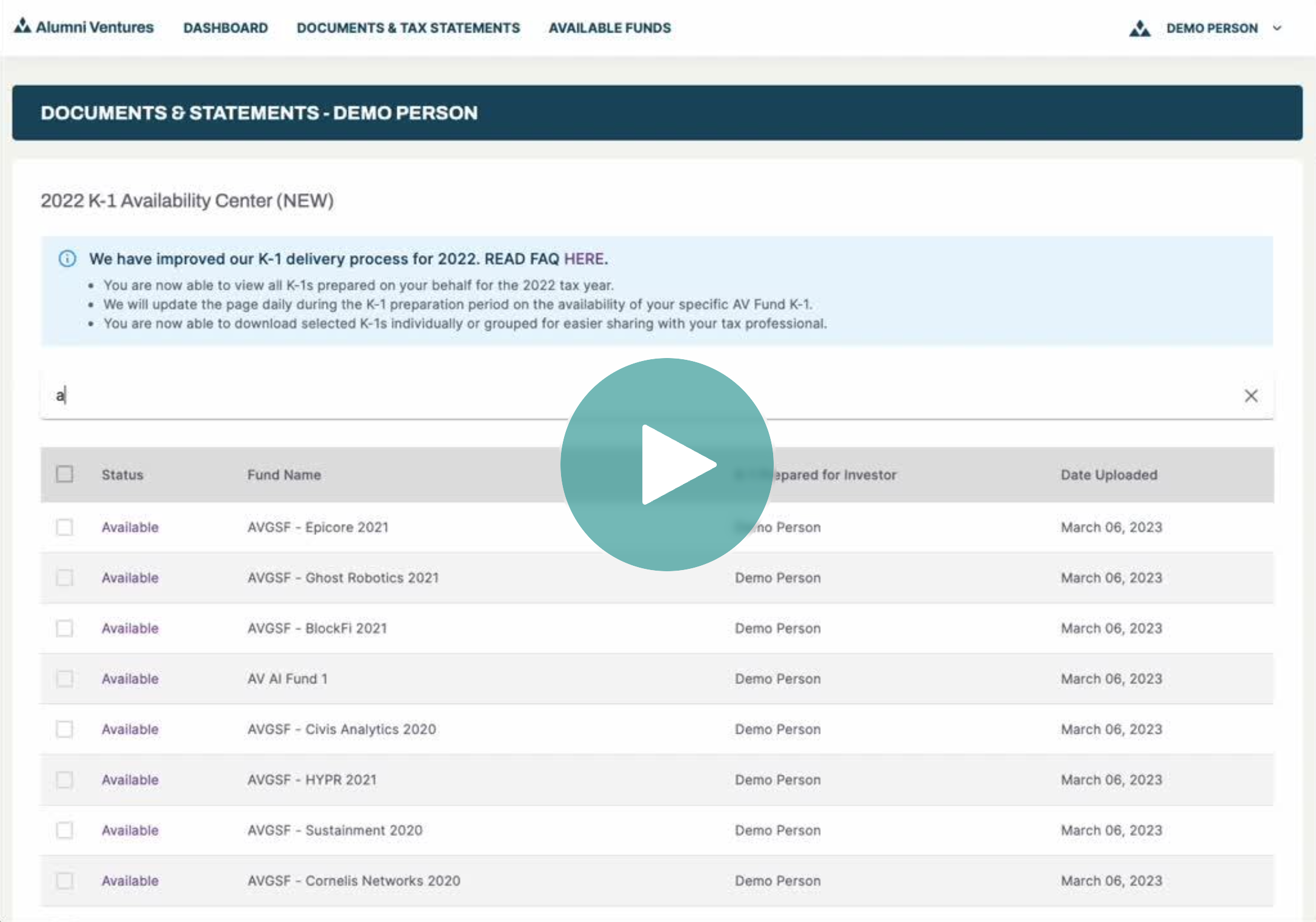

How To Use AV’s K-1 Availability Center

As always, you can email Investor Services at investor.relations@av.vc for assistance.

Frequently Asked Questions

FAQ

We anticipate sending all 2025 K-1s by March 31, 2026. If there are any unexpected delivery delays, we will notify you as soon as possible.

K-1s require accurate and complex analysis of tax implications related to all 1,600+ portfolio companies. It’s quite rare to receive any K-1s prior to normal tax deadlines. Each year, we make this a top priority because we know it makes a difference to our investors.

It’s possible that some K-1s will be available prior to March 31. You can check by logging in, click on the “Access K-1s” on your Message Center, or click “Documents & Tax Statements” in the top navigation bar and then scroll down to “Tax Statements.”

In your AV Investor Portal, click on “Documents & Statements” and then you can access your “K-1 Availability Center,” which will provide you with a status for each K-1 that you will be issued.

By default, all investors have access to electronic copies of their K-1(s) in the AV Investor Portal, and we will also mail paper copies unless you choose electronic-only delivery. If you prefer to receive your K-1(s) online only (and not have them mailed), please update your delivery preference by following these steps:

- Log into your Investor Portal.

- Click the drop-down in the upper right-hand corner of the Dashboard.

- Choose “My Settings” and then “Contact Information.”

- Under K1 Tax Statement Preference, select electronic-only.

If you’ve opted to receive your K-1(s) electronically, we will notify you when they’re ready on or before March 31, 2025.

Please note: To ensure we can meet your needs, please submit any updates to your delivery preferences by April 1, 2026. Updates received after this date may not be applied to 2025 tax-year documents, and you may still receive your K-1(s) by mail. Thank you for your understanding.

Your investment in 2026 will be reflected on your tax year 2026 Schedule K-1, which will be delivered in March 2027.

K-1 forms will be generated for any investments made via retirement funds and uploaded to your AV Investor Portal. Please consult your tax advisor to determine your filing requirements.

Please consult your tax advisors on your personal filing requirements.

If you are a non-U.S. investor who invested via the offshore vehicle (AVG Global Investor Fund 1, LP), then you will not receive a Schedule K-1. Instead, you will receive a AVG Global Investor Fund 1, LP tax summary statement detailing tax activities for your investment(s). If you are a non-U.S. investor who did not invest via the offshore vehicle (AVG Global Investor Fund 1, LP), then you will receive a tax year 2025 Schedule K-1.

Your Schedule K-1 for tax year 2025 will generally reflect the address we have on file as of December 31, 2025. An outdated address on your K-1 does not typically prevent you from filing your return, because the IRS generally matches K-1 information to your tax return using your taxpayer identification number (TIN), name, and the amounts reported, rather than relying on the address printed on the form.

If you would like to update your address for future mailings and reporting, please email our Investor Services Team at investor.relations@av.vc. For questions about how this affects your specific tax situation, please consult your tax advisor.

As JTIC subscribers, both you and your joint-subscriber own an equal split (50%) of the total investment — as reflected on your separate K-1s. Each of you also have your own mutually exclusive Investor Portal account. As such, you will each receive an individual K-1 for your proportional ownership of the investment within your individual Investor Portal account.

If you suspect an error, please email our Investor Services Team at investor.relations@av.vc. To ensure that corrections are made for the 2025 tax year, please submit the necessary amendments no later than June 30, 2026.

This a new schedule created by the IRS for tax year 2021 and onward. The Form 1065 Schedule K-3 reports an investor’s distributive share of items of international tax relevance and is an extension of the Form 1065 Schedule K-1. It replaces line 16, portions of line 20, and numerous unformatted statements attached to prior versions of the Schedule K-1 Form 1065, Schedule K-1. You are getting a Schedule K-3 because the fund is required to report an investor’s distributive share of items of international tax relevance. Please consult your tax advisor.

Each Alumni Ventures fund is its own legal and tax entity. Schedule K-3 reporting is required only for Funds that have certain international tax relevance (such as foreign-source income or foreign taxes) in a given tax year. If you do not receive a K-3 for a particular Fund, it generally means there were no items of international tax relevance that needed to be reported to you for that Fund and tax year. Please consult your tax advisor regarding your personal filing requirements.