Genetesis: Improved Delivery of Cardiac Diagnostics

Creating technology that can rapidly diagnose the severity of chest pain symptoms

Over 8 million Americans go to the ER each year for chest pain, making it the second-largest cause of emergency visits. Though very few of these visits result in life-threatening situations, all patients must undergo lengthy observation and testing at a considerable expense to clinicians and hospitals. Beyond the waste of resources, testing low-risk patients can even lead to needless risks and unnecessary care costs with little value.

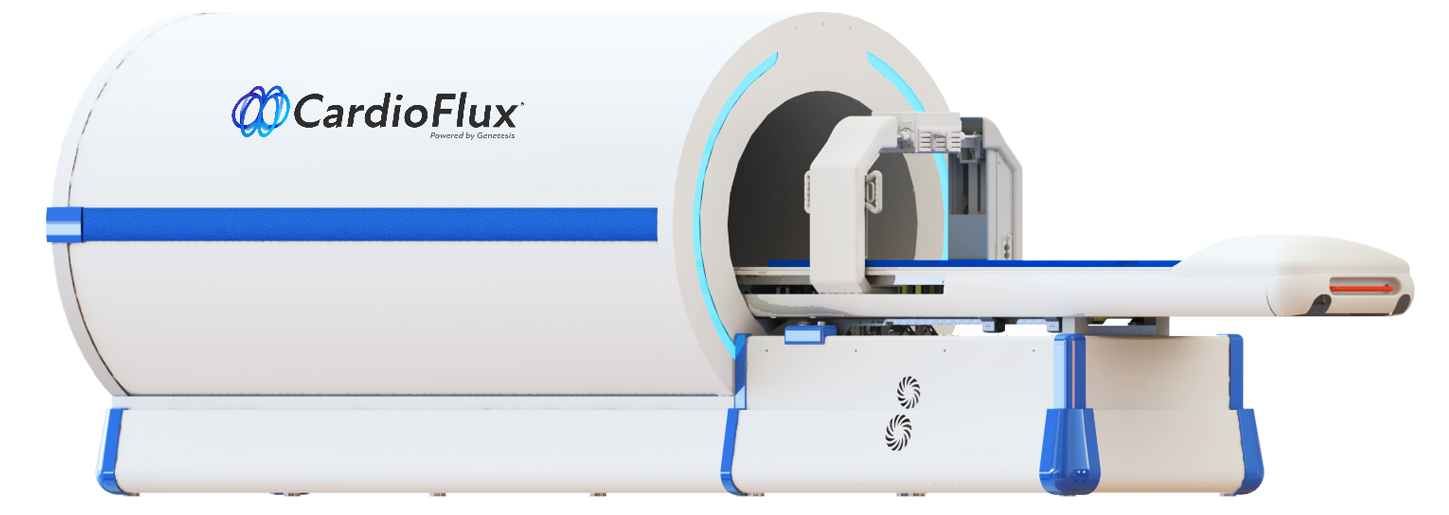

Alumni Ventures portfolio company Genetesis has a better solution. The company has developed an MRI-like machine called CardioFlux that can rapidly diagnose the severity of chest pain symptoms without needing more intrusive, costly, and time-consuming testing. CardioFlux is the only FDA-cleared, non-invasive, radiation-free cardiac diagnostic technique that can be completed in minutes with accuracy, rivaling invasive testing such as a coronary angiogram.

Becoming An Industry Leader

Genetesis taps into multiple revenue streams by selling the CardioFlux machine to health systems and outpatient centers and charging a SaaS fee to cover maintenance and service requirements. To reach commercial status, Genetesis has completed several industry-specific hurdles, including:

- 510(k) clearance in 2019

- Breakthrough designation in 2020

- Three clinical trials, with crucial data peer-reviewed and presented at ACEP, AHA, and SCAI

- A portfolio of patents and trademarks

Genetesis’ technology is non-invasive, radiation-free, rapid, and designed to seamlessly integrate into any hospital workflow.

What We Liked About Genetesis

Significant Total Addressable Market: There are approximately 8,400 ER rooms and cardiology outpatient centers where the CardioFlux machine would be relevant.

Strong Lead Investor: Mithril Capital is leading the round. The firm has a proven track record of investing in leading deep-tech companies, particularly healthcare. For example, it was an early (and ultimately the largest) investor in Auris Health, acquired by Johnson & Johnson for $3.4 billion.

Strong Team Backed by Industry Leaders:

The Genetesis team has surrounded themselves with notable experts across healthcare, regulatory, technology, and scientific fields. The company’s formal Scientific Advisory Board comprises MDs from Brigham and Women’s, Ascension St. John Hospital, Baylor College of Medicine, Wake Forest Baptist Health, and Humana. Additionally, the company’s External Board of Directors includes Mark Cuban, Bill Baumel, Sajid Malhotra, Anil Achyuta, and John Rice.

In addition to being backed by industry leaders, Genetesis’ co-founders Vineet Erasala, Manny Setegn, and Peeyush Shrivastava were named to the Forbes 30 Under 30 — an exclusive list of entrepreneurs and scientists under the age of 30 who are “working to expand access to care and to treat and cure disease.”

How We Are Involved

116 Street Ventures (for the Columbia community) deployed capital in Genetesis’ $17.5 million Series C alongside sibling fund Ring Ventures (for the Texas A&M community) and Alumni Ventures’ Healthtech Fund and Total Access Fund.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.